Enthusiasm was in abundance at PDAC 2024.

By Ian Foreman

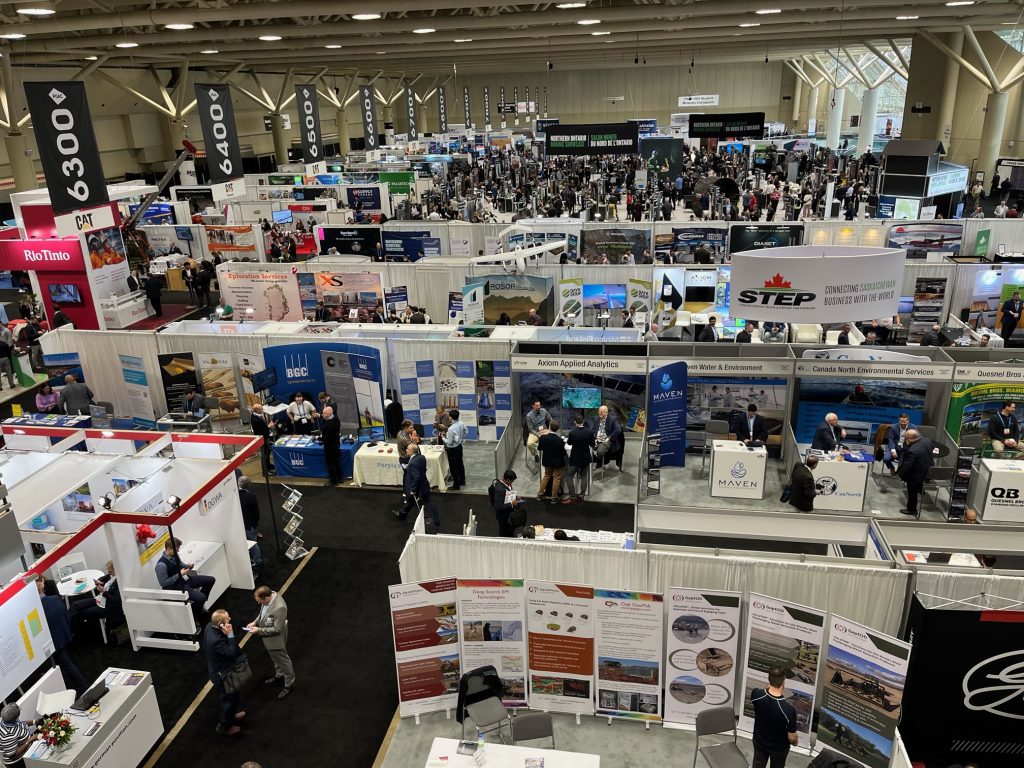

The Prospectors and Developers Association of Canada annual conference, simply known as the PDAC, saw the who’s who of the mining and exploration sector converge on Toronto last week. The enthusiasm that is inherent to conferences was magnified this year as this was the first year that the PDAC coincided with value of gold hitting all time highs.

“2024 will be a transformative year for our company,” stated Roger Rasmus, CEO of Goliath Resources Ltd. (TSX-V: GOT, FSE: B4IF, OTC: GOTRF). The Investors Exchange was reverberating with similar sentiment where 450 companies were competing for attention. The Majors were there as were Juniors of every stripe – it seemed that every commodity and jurisdiction were represented. Each company was putting their best foot forward, whether they were boasting recent wins are promoting the potential for their projects.

And for those looking for an early-stage opportunity, there were 20 prospectors on hand to show their hard work. It is a pity that many may have overlooked them as some of the companies that were garnering a lot of attention actually got their projects in whole or in part from prospectors.

And for those looking for an early-stage opportunity, there were 20 prospectors on hand to show their hard work. It is a pity that many may have overlooked them as some of the companies that were garnering a lot of attention actually got their projects in whole or in part from prospectors.

The convention was rounded out with 752 service providers exhibiting in the Trade Show. The PDAC has come a long way from the early 2000’s when the entire conference fit on the floor of the north hall; today just the Trade Show portion occupied half of the south and all of the north hall.

But the show floor wasn’t where all the action was; the social events continue to be an important aspect of the convention. These more casual gatherings were rife with not just schmoozing and networking but the occasional deal. “Things are happening behind the scenes,” teased Farshad Shirvani, president and CEO of Doubleview Gold Corp. (TSX-V: DBG, GER: A1WO38, OTC: DBLVF), which is set to announce its first resource that includes scandium.

Long gone are the days where the Royal York Hotel was the only site for hospitality suites as this year social functions took over downtown Toronto. It seemed that every bar and attraction was utilized on at least one evening with the popular large locations being the Hockey Hall of Fame and Ripley’s Aquarium. This was a by-product of the shear size of the convention. Even this year, a quieter year, attracted an impressive 26,926 attendees.

Drilling was a common theme that companies were touting. Not surprisingly, as without drilling there are no discoveries, deposits aren’t expanded, and economic studies aren’t possible.

Tudor Gold Corp. (TSX-V: TUD, FSE: H56, OTC: TDRRF) has set their next drill program at between 15 and 18,000 metres. The program will concentrate on their newly discovered high-grade gold breccia system at the Goldstorm deposit with the focus on delineating a sweetener for their recently increased resource.

Abitibi Metals Corp. (CSE: AMQ, FSE: FW0, OTC: AMQFF) has 30,000 metres of drilling planned for 2024 at their high-grade B26 polymetallic coper deposit. The objectives will be to determine the initial parameters and portion of the deposit that could fall within a conceptual open pit, confirm the nature of the high-grade zones, and to expand the deposit at depth.

Osisko Metals Inc. (TSX-V: OM, FSE: OB51, OTC: OMZNF) will be drilling a combined 25,000 metres at its projects. The company plans to have new resource estimates for both Pine point, which is moving into the feasibility stage, and Gaspe, which is at the PEA stage.

Snowline Gold Corp.’s (TSX-V: SGD, OTC: SNWGF) fourth drill season will be the company’s biggest program to date. They will be advancing the Valley Deposit as well as drilling additional exploration targets that have been prioritized from diligent off-season compilation.

But not to be outdone, New Found Gold Corp. (TSX-V: NFG, NYSE-A: NFGC) will have what is most probably the largest drill program in Canada with 125,000 metres of drilling planned. To date there has been little to no drilling below a depth of 250 metres and a recent geophysics study indicated that mineralization potentially continues to at least 400 m.

Other companies peppered throughout the Investor Exchange were touting the advancements on their projects, either with a new or updated resource estimation, a preliminary economic assessment (or ‘PEA’), or a prefeasibility study.

Blue Sky Uranium Corp. (TSX-V: BSK, FSE: MAL2, OTC: BKUCF) is taking advantage of a surge in enthusiasm for uranium. “Our new robust PEA is out, which is setting us up for the next phase where we advance to the pre-feasibility stage,” stated Niko Cacos, president and CEO.

Defense Metals Corp. (TSX-V: DEFN, FSE: 35D, OTC: DFMTF) stated that a pre-feasibility should be ready for the end of June and that they are working towards a non-dilutive financing that should be announced within the next 60 days.

Vizsla Silver Corp. (TSX-V: VZLA, NYSE: VZLA) promoted that their 325 million combined ounces of silver is contained within only 10% of the project. They have brought on a proven mine builder as their new COO. Plans for 2024 include a 25,000 tonne bulk sample as well as a PEA.

For Argentina Lithium & Energy Corp. (TSX-V: LIT, FSE: OAY3, OTC: LILIF) the recent pull back in the lithium sector has allowed them to assess and readdress a number of potential opportunities. They plan to announce a maiden resource on their wholly Rincon Project later this year. And they won’t stop there as they were recently cashed up to the tune of US $90 million with an investment by Peugeot Citroen Argentina S.A., a subsidiary of Stellantis N.V.

Nouveau Monde Graphite Inc. (TSX-V: NOU, NYSE: NMG) with a pair of recently signed multiyear offtake agreements in hand is holding to their motto of working towards a sustainable future. In the coming year they will be finishing engineering and planning for construction with the objective of a formal decision formal production decision in early 2025.

On the deal front, I-80 Gold Corp. (TSX: IAU, NYSE: IAUX) was garnering attention for another reason. Recently the company had announced a pending joint venture agreement for their Ruby Hill project. They were fending off questions regarding which company that deal had been inked with and the terms of the deal. They plan to announce the details in early May when the other company has completed its due diligence and signed the definitive agreement.

As a company that fits into a unique category due to them having a fully carried 20 percent interest until notice of production in the Treaty Creek project, American Creek Resources Ltd. (TSX-V: AMK, OTC: ACKRF) is thrilled that their project has new access and dramatically improved infrastructure due to Seabridge Gold’s (TSX: SEA, NYSE: SA) $300 million investment in their neighbouring KSM Project.

And, trying to not be outshone by the big boys, several small mining companies were in attendance and pleased to show off their advancements.

Steppe Gold Ltd. (TSX: STGO, OTC: STPGF), which is currently completing $150 million of financing in trenches, has acquiring a second producing gold mine in Mongolia. The combined production is set to expand to between 60 and 90,000 ounces per year with ultimate goal being 160,000 ounces per year as a target.

Luca Mining Corp. (TSX-V: LUCA, OTC: LUCMF), also with two mines in its portfolio, was proudly stating that they had turned things around as they had improved operations and doubled recoveries as a result. Their goal is to be cash flow positive in the next six months and produce 70,000 gold equivalent ounces from both projects in 2024.

All told, it was a successful show. Each company there was eager to elaborate on their accomplishments of 2023 and keen for what 2024 holds. All indications are that 2024 is going to be a significant year in the mining and exploration sector. If that is the case, then it will be a fast twelve months until PDAC 2025.